credit risk - Exposure At Default: Calculating the present value - Quantitative Finance Stack Exchange

Article 50b General rules for the calculation of KCCP | Regulation 648/2012/EU - EMIR Regulation | Better Regulation

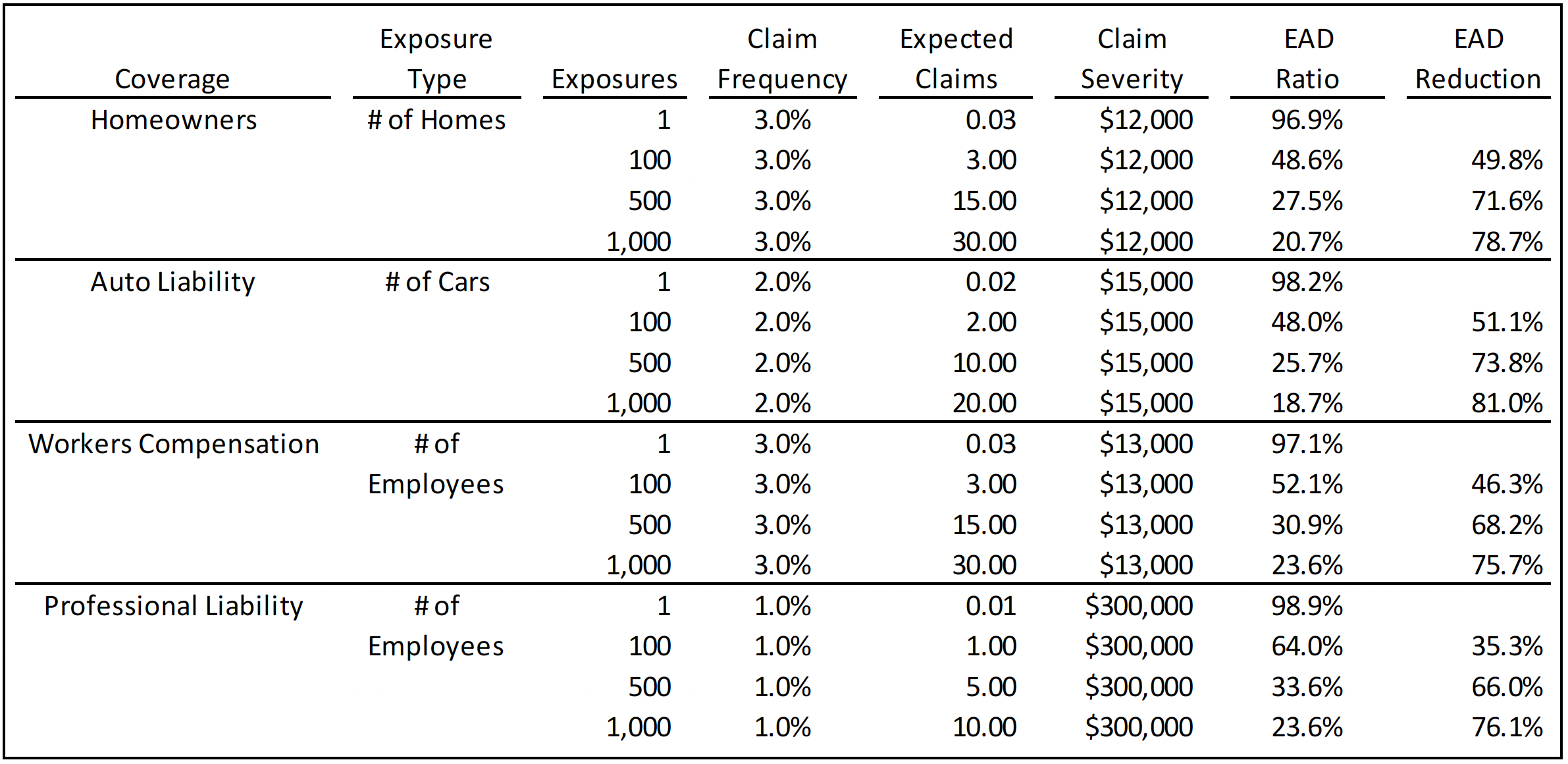

Accepting a Regulatory Gift: Exceeding Rising Credit Risk Quantification Standards - Global Financial Markets Institute

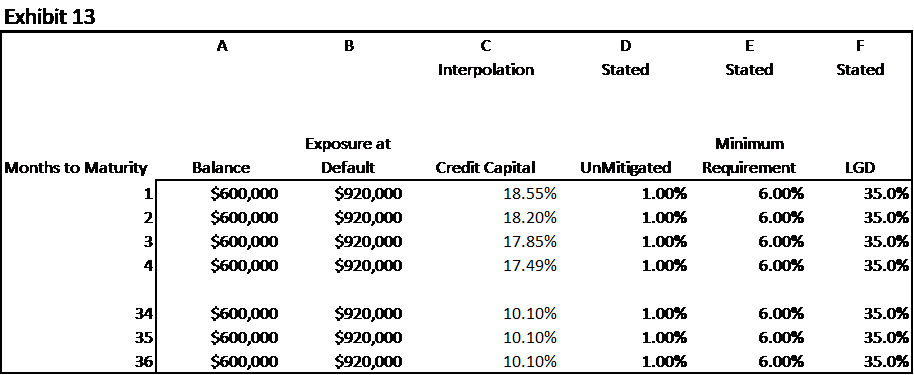

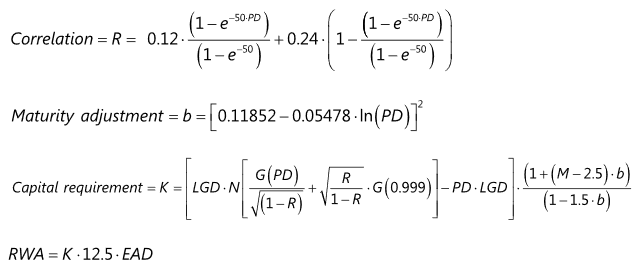

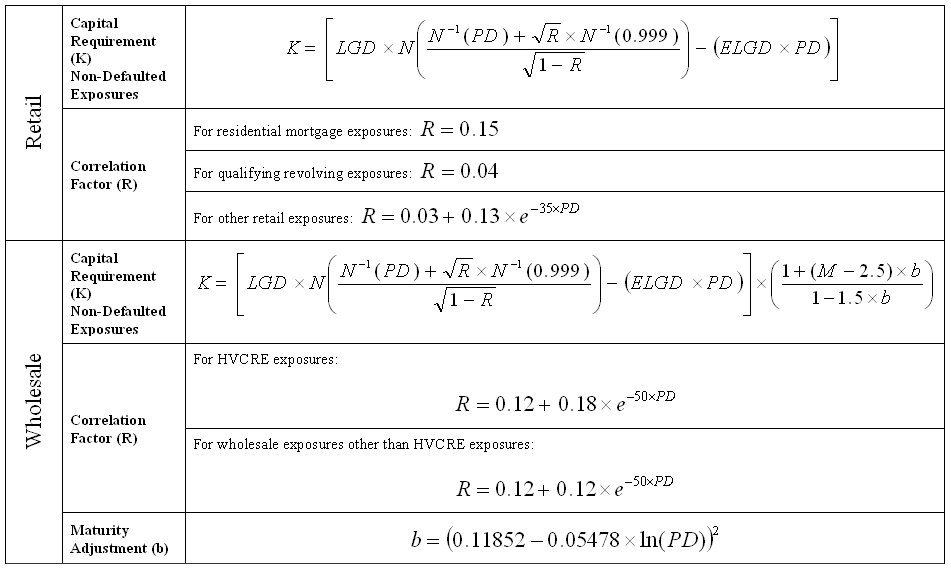

Basel II Capital Accord - Notice of proposed rulemaking (NPR) - Proposed Regulatory Text - Part IV - Risk-Weighted Assets for General Credit Risk