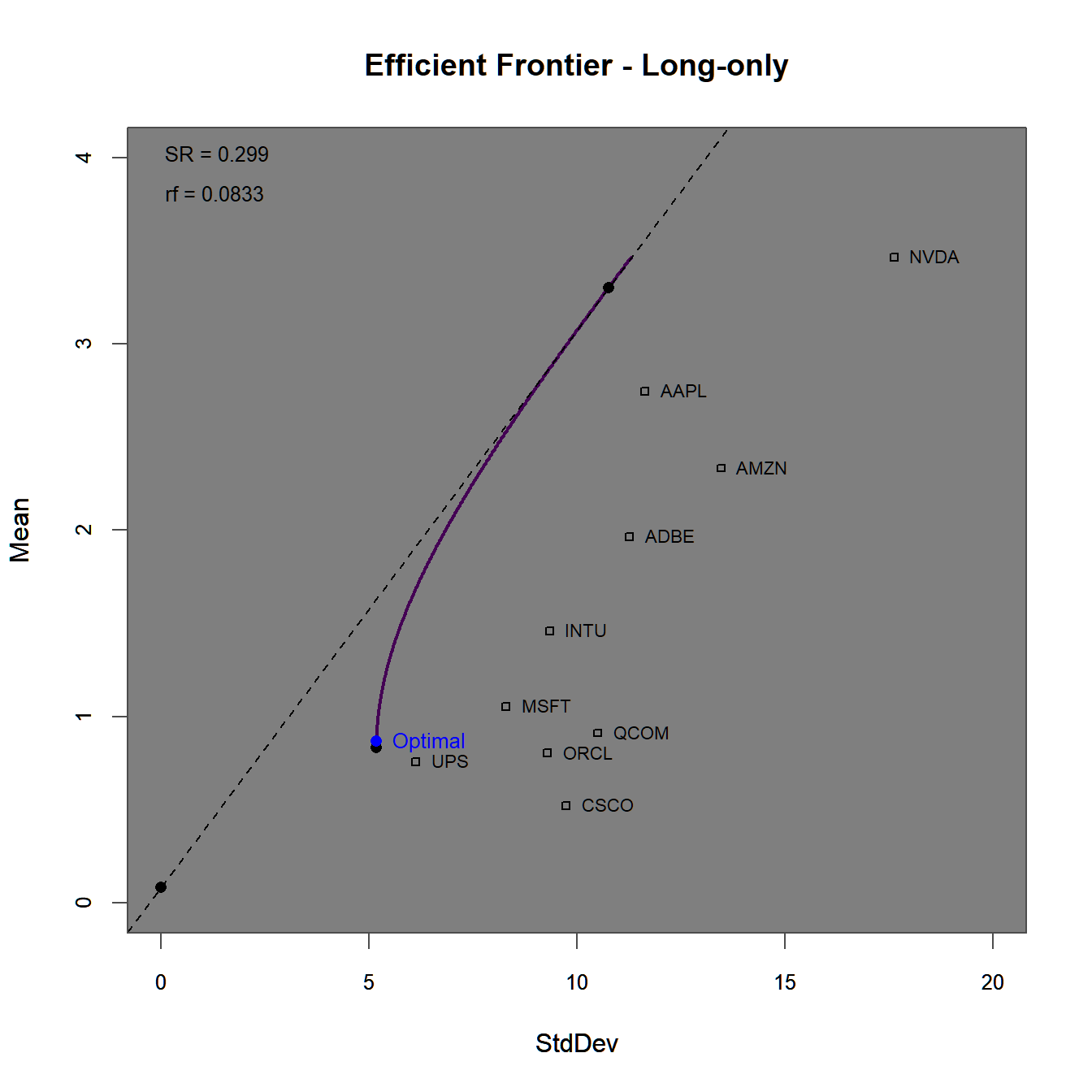

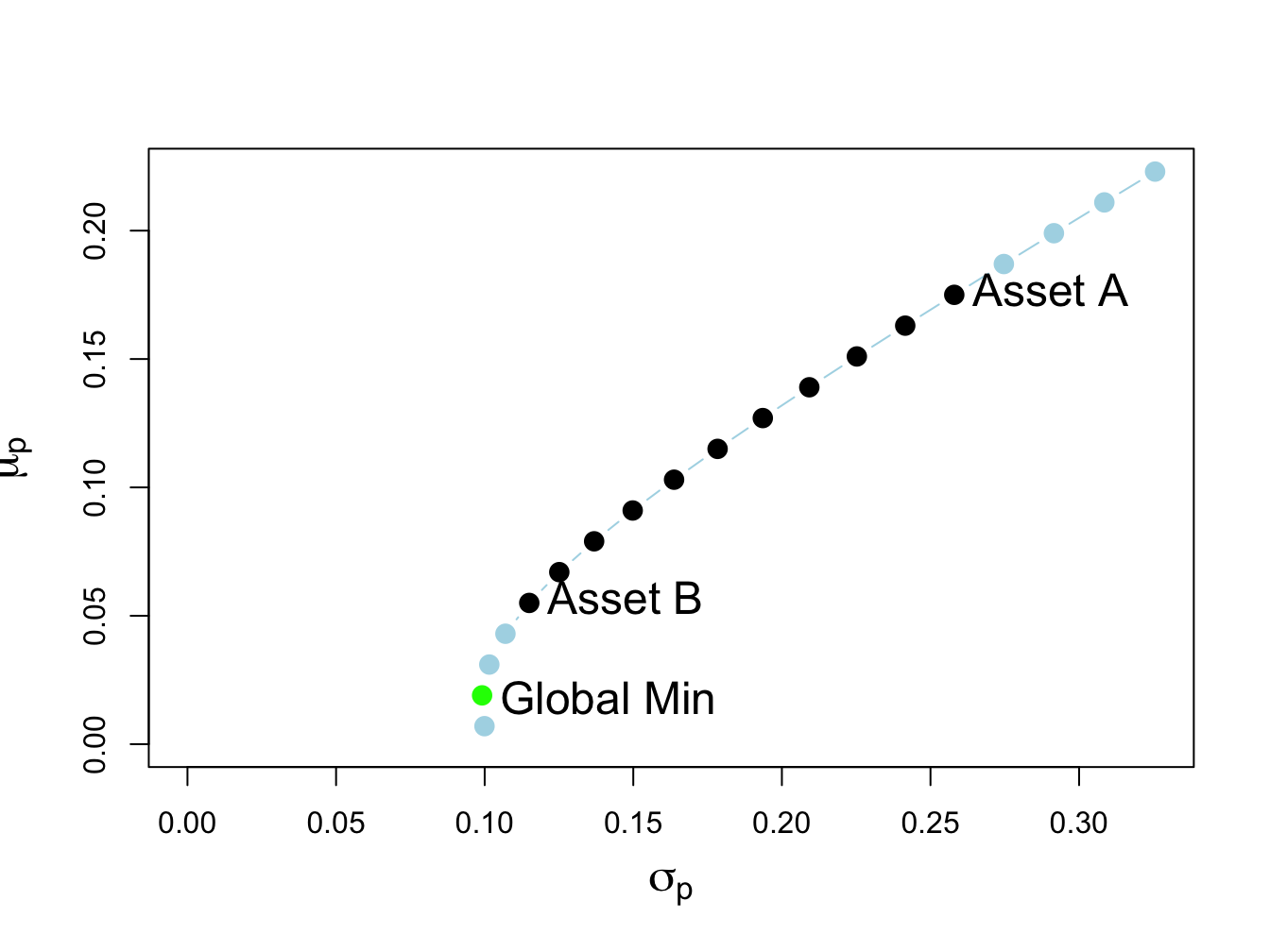

13 Portfolio Theory with Short Sales Constraints | Introduction to Computational Finance and Financial Econometrics with R

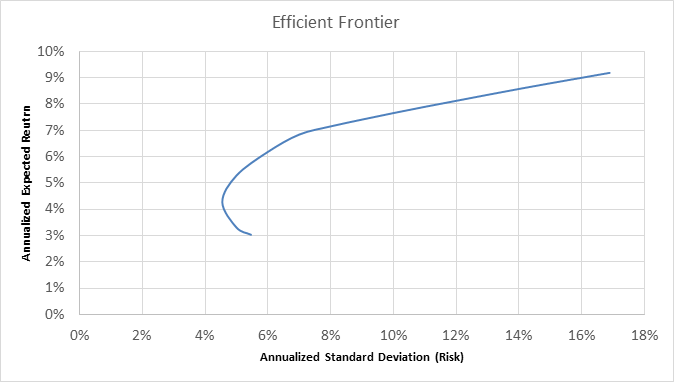

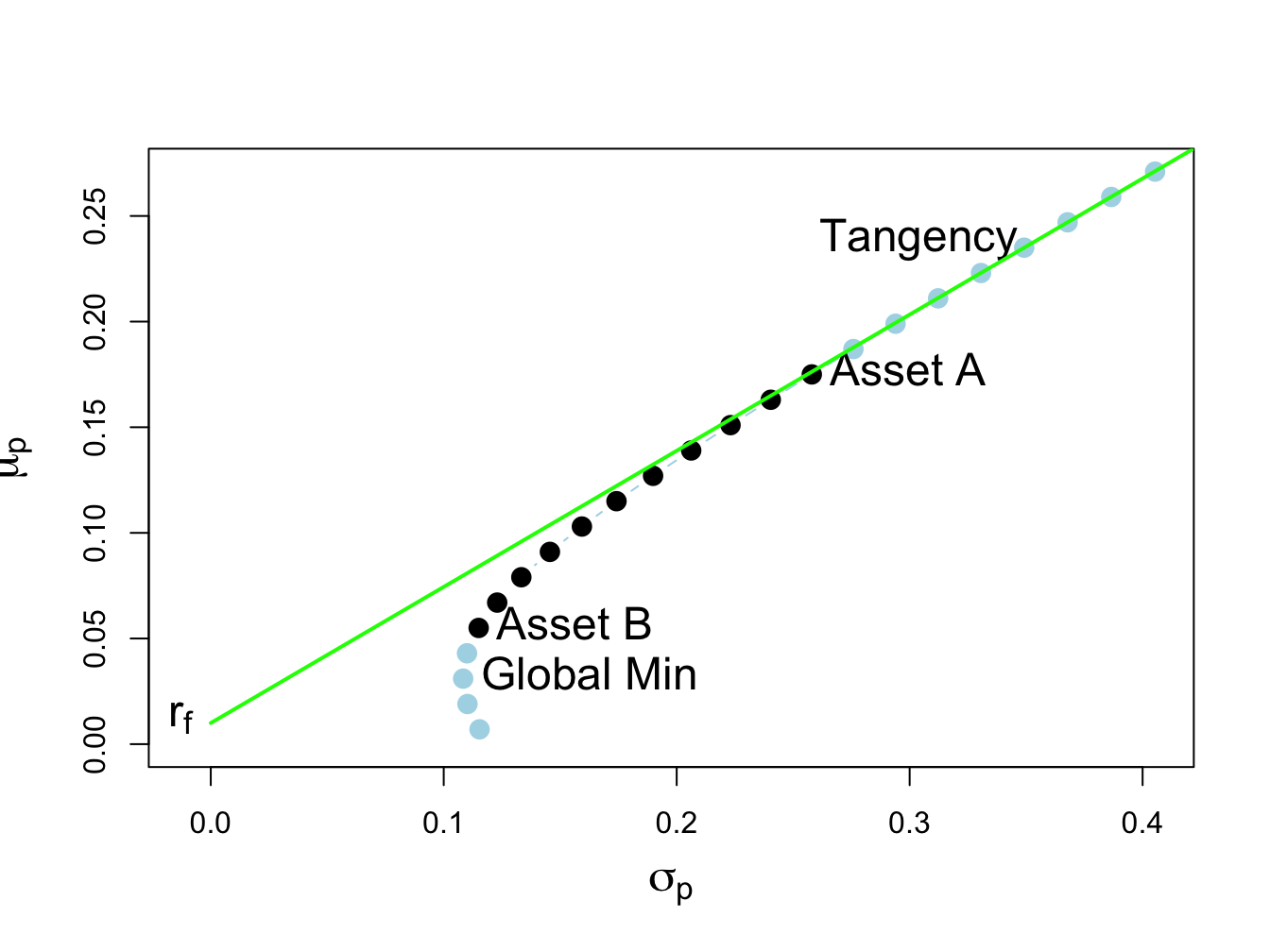

Efficient Frontier - Portfolio optimisation (optimization) with and without short-selling - File Exchange - MATLAB Central

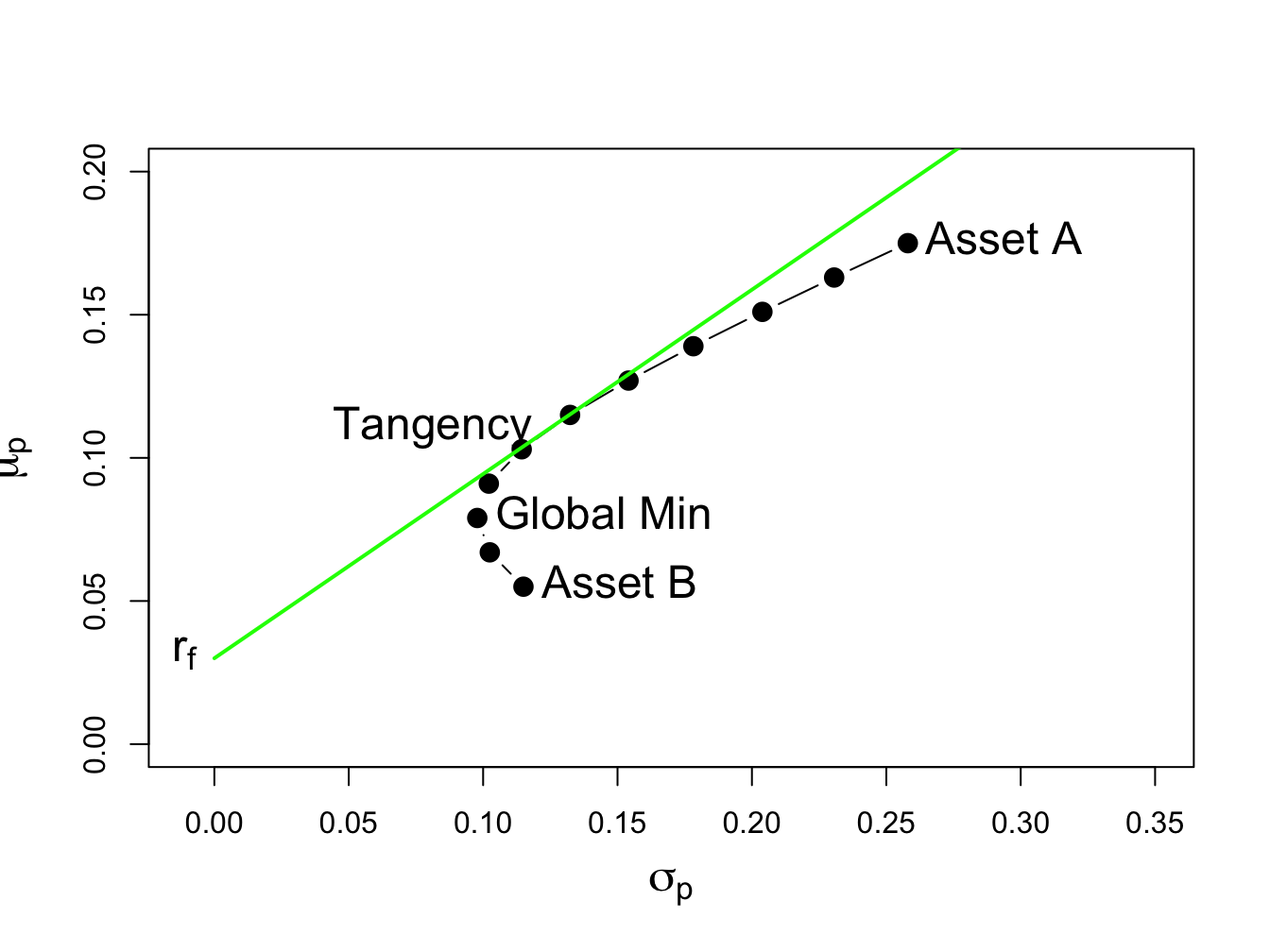

Efficient frontiers without short sales (on the left) and with short... | Download Scientific Diagram

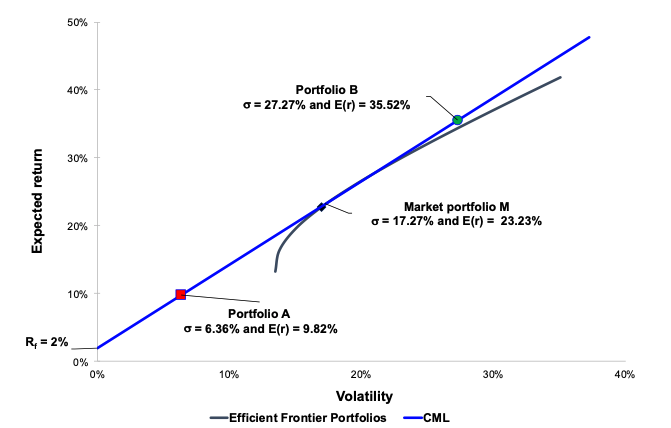

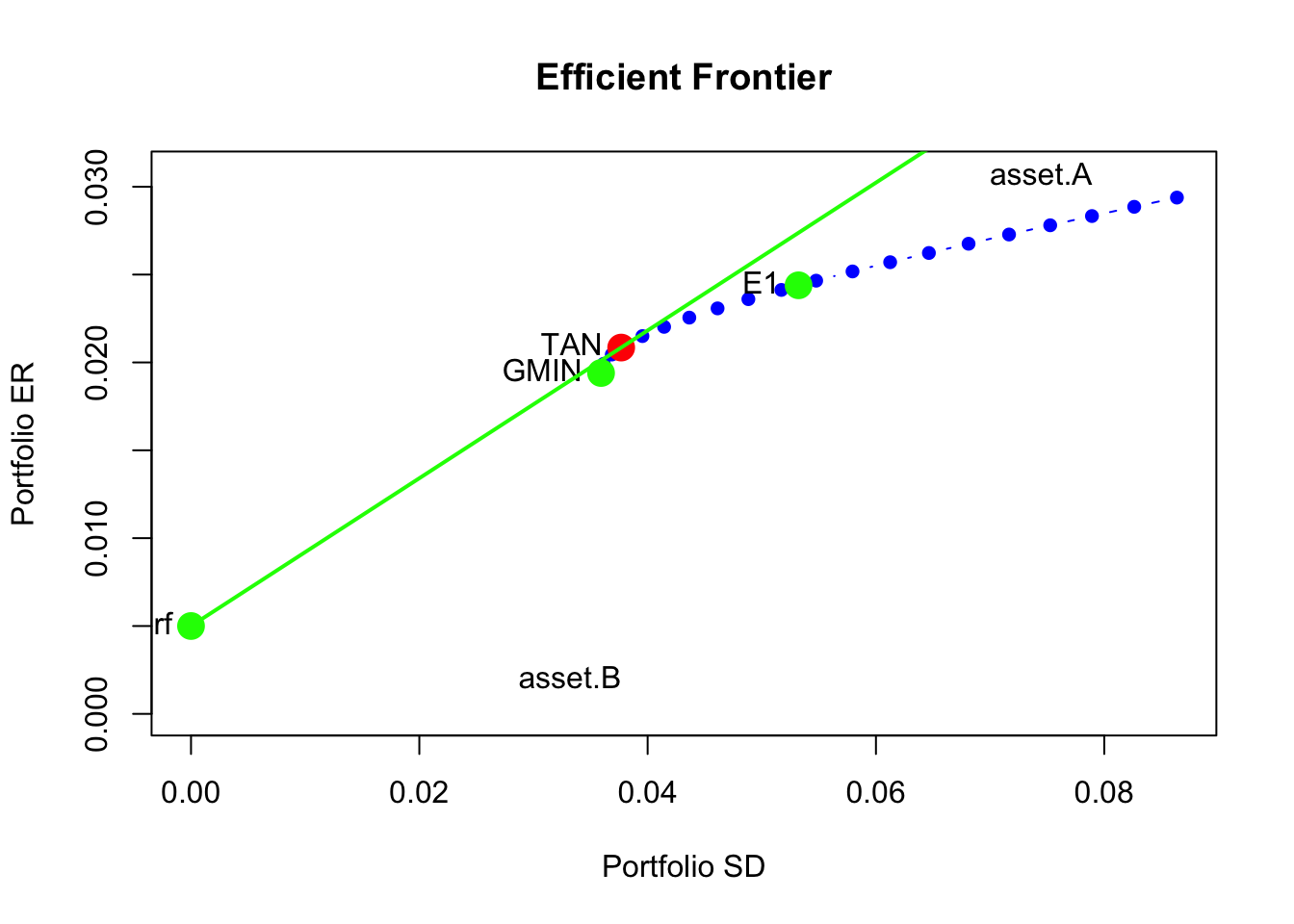

13 Portfolio Theory with Short Sales Constraints | Introduction to Computational Finance and Financial Econometrics with R

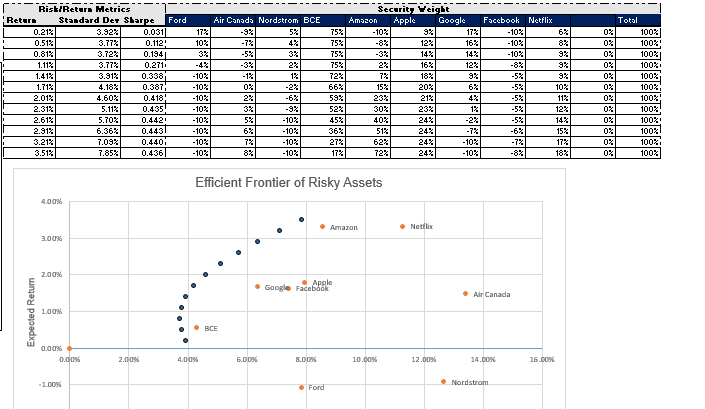

portfolio management - Max allowable return in Markowitz model - Quantitative Finance Stack Exchange

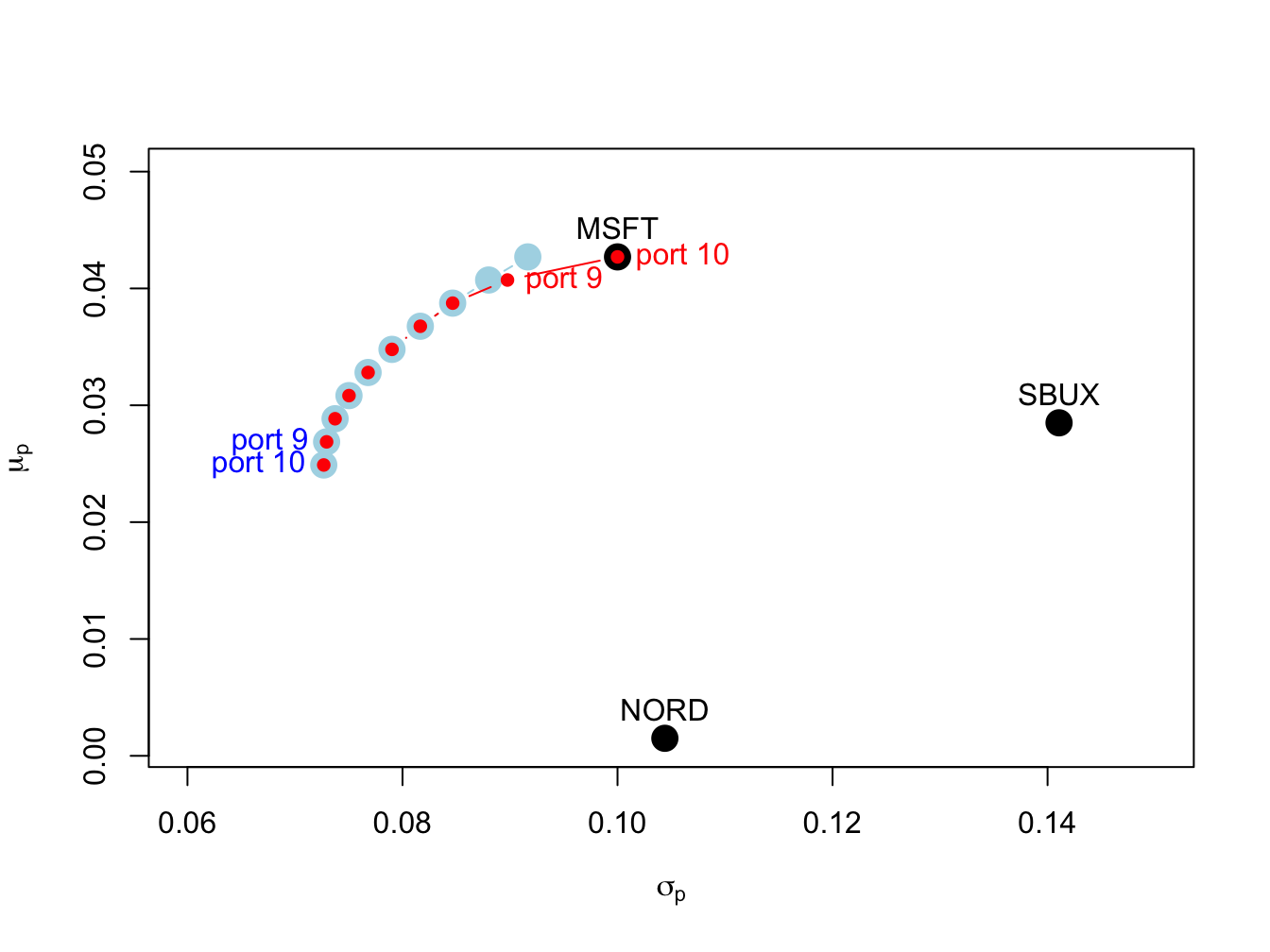

The efficient frontier for the ten assets with and without short sales... | Download Scientific Diagram

13 Portfolio Theory with Short Sales Constraints | Introduction to Computational Finance and Financial Econometrics with R

Efficient frontiers without short sales (on the left) and with short... | Download Scientific Diagram

13 Portfolio Theory with Short Sales Constraints | Introduction to Computational Finance and Financial Econometrics with R

13 Portfolio Theory with Short Sales Constraints | Introduction to Computational Finance and Financial Econometrics with R