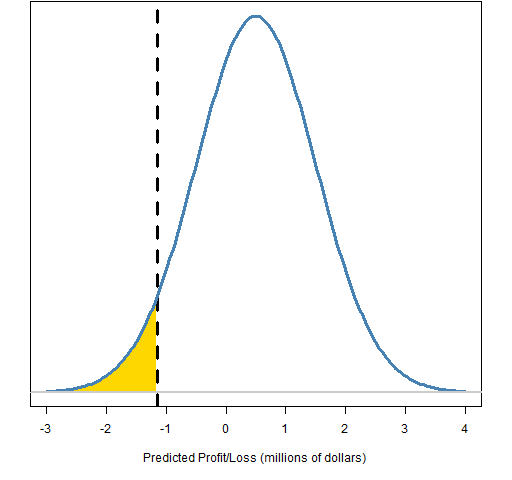

RIB Working Paper Series: RIB17-100005 Value at Risk and Expected Shortfall Estimation for China Securities Market

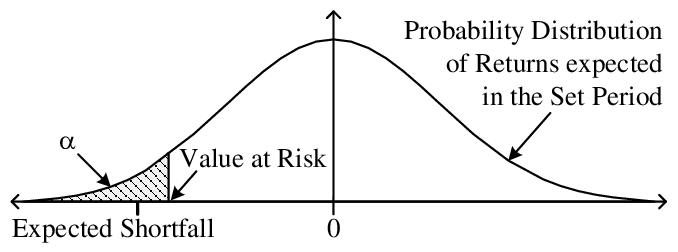

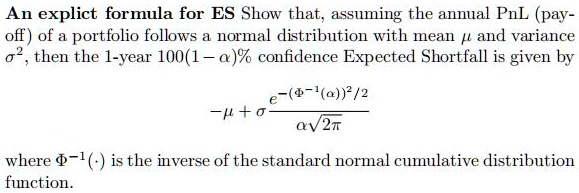

SOLVED: An explict formula for ES Show that; assuming the annual PnL (pay off) of a portfolio follows a normal distribution with mean / and variance then the 1-year 100(1 a)% confidence

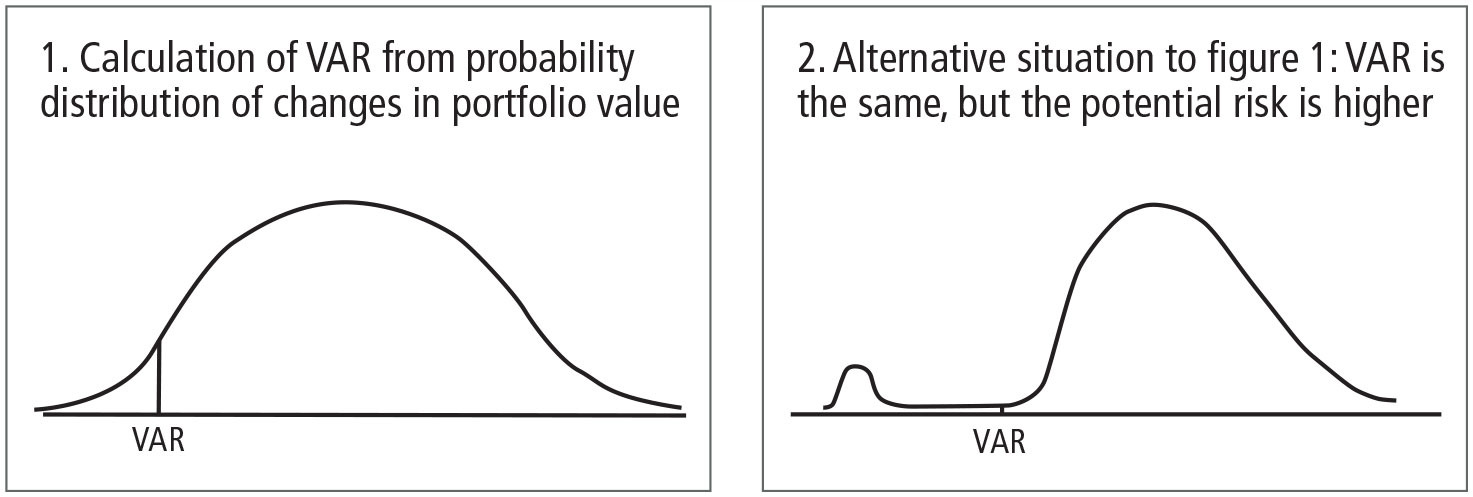

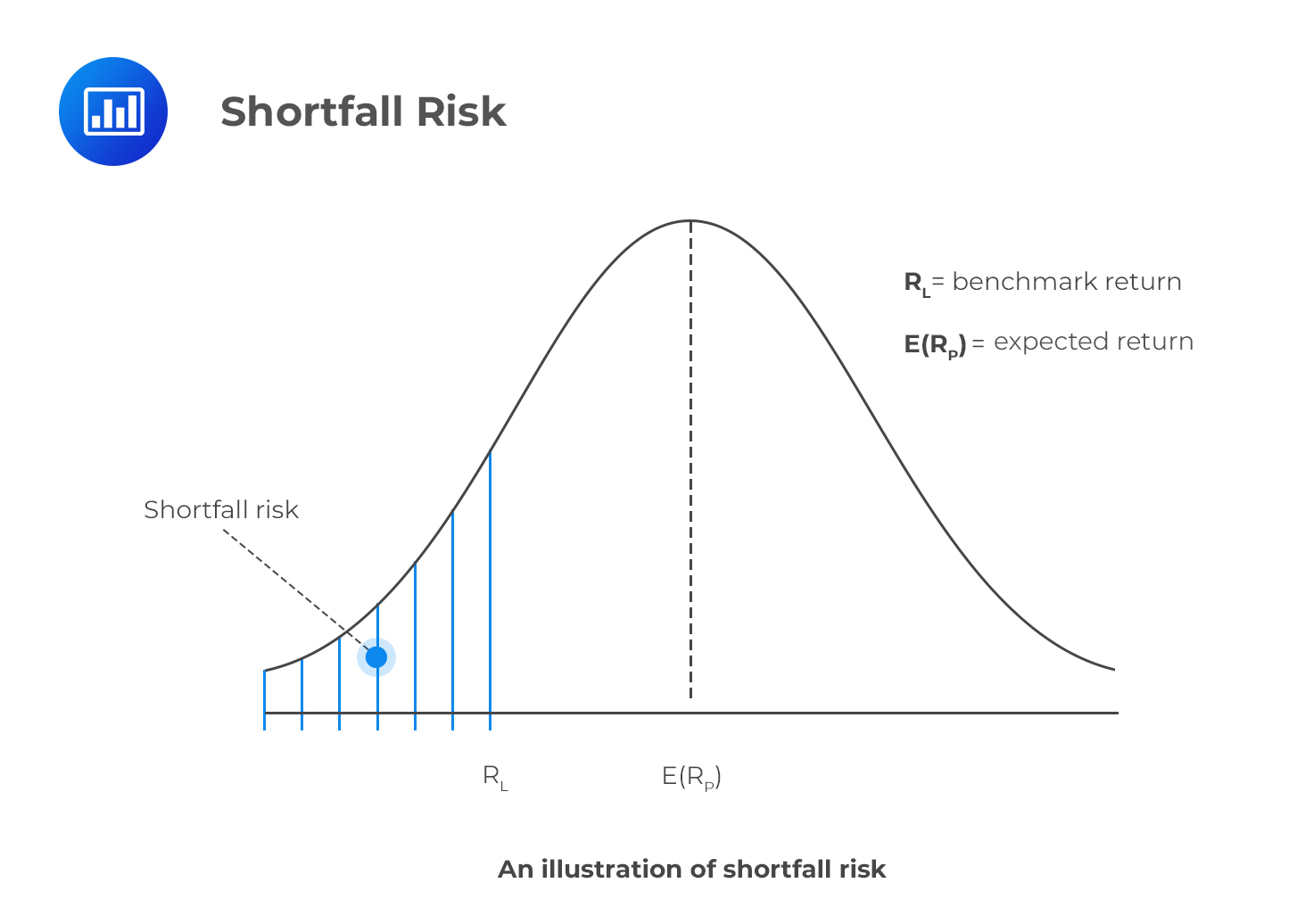

Article 325bb Expected shortfall risk measure | Regulation 575/2013/EU - Capital Requirements Regulation CRR (UK CRR as onshored by HM Treasury) (Retained EU Law) | Better Regulation