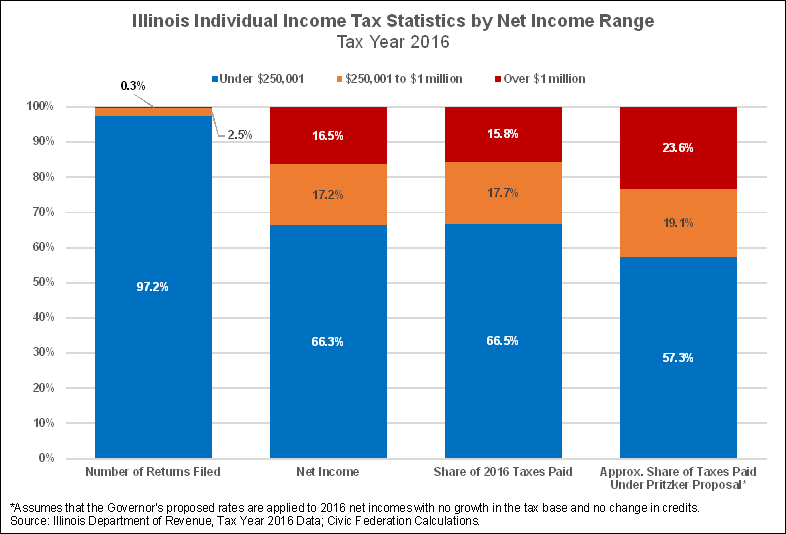

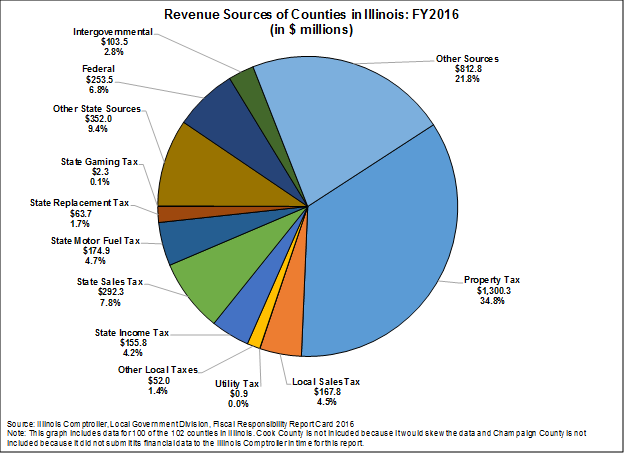

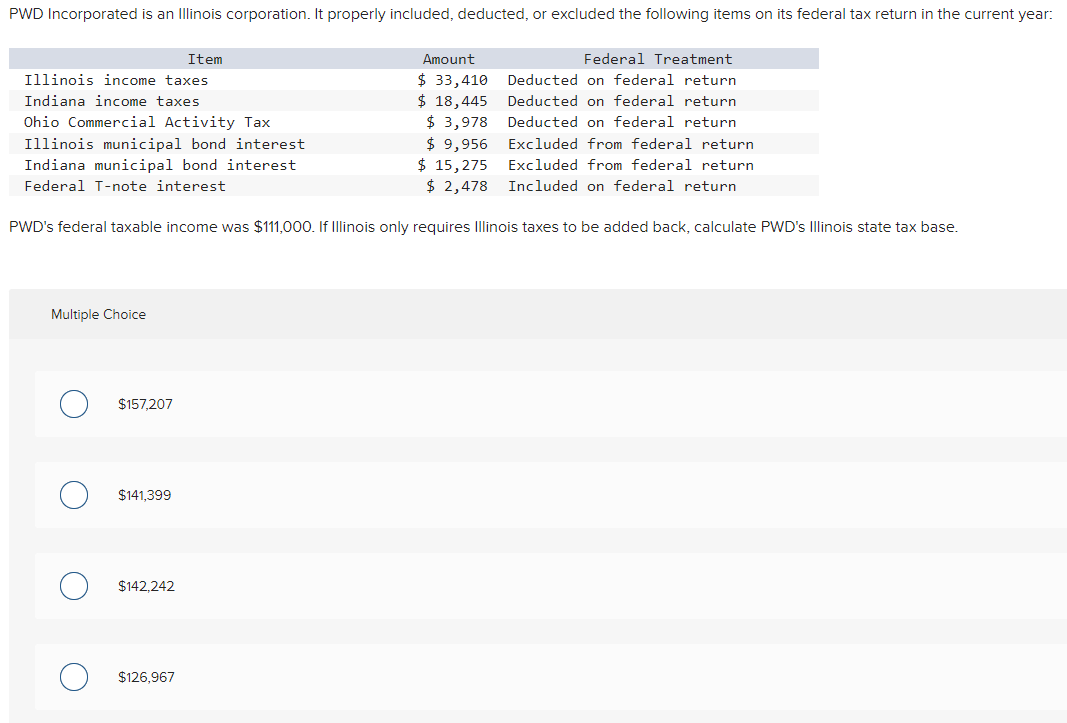

The Caucus Blog of the Illinois House Republicans: Calculating estimated state taxes during COVID-19 pandemic

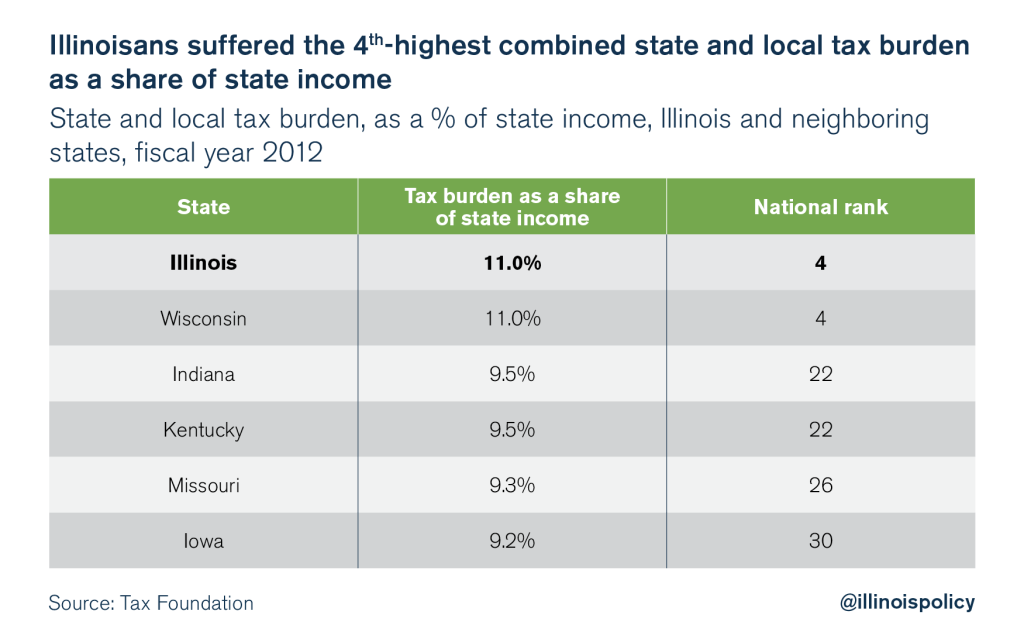

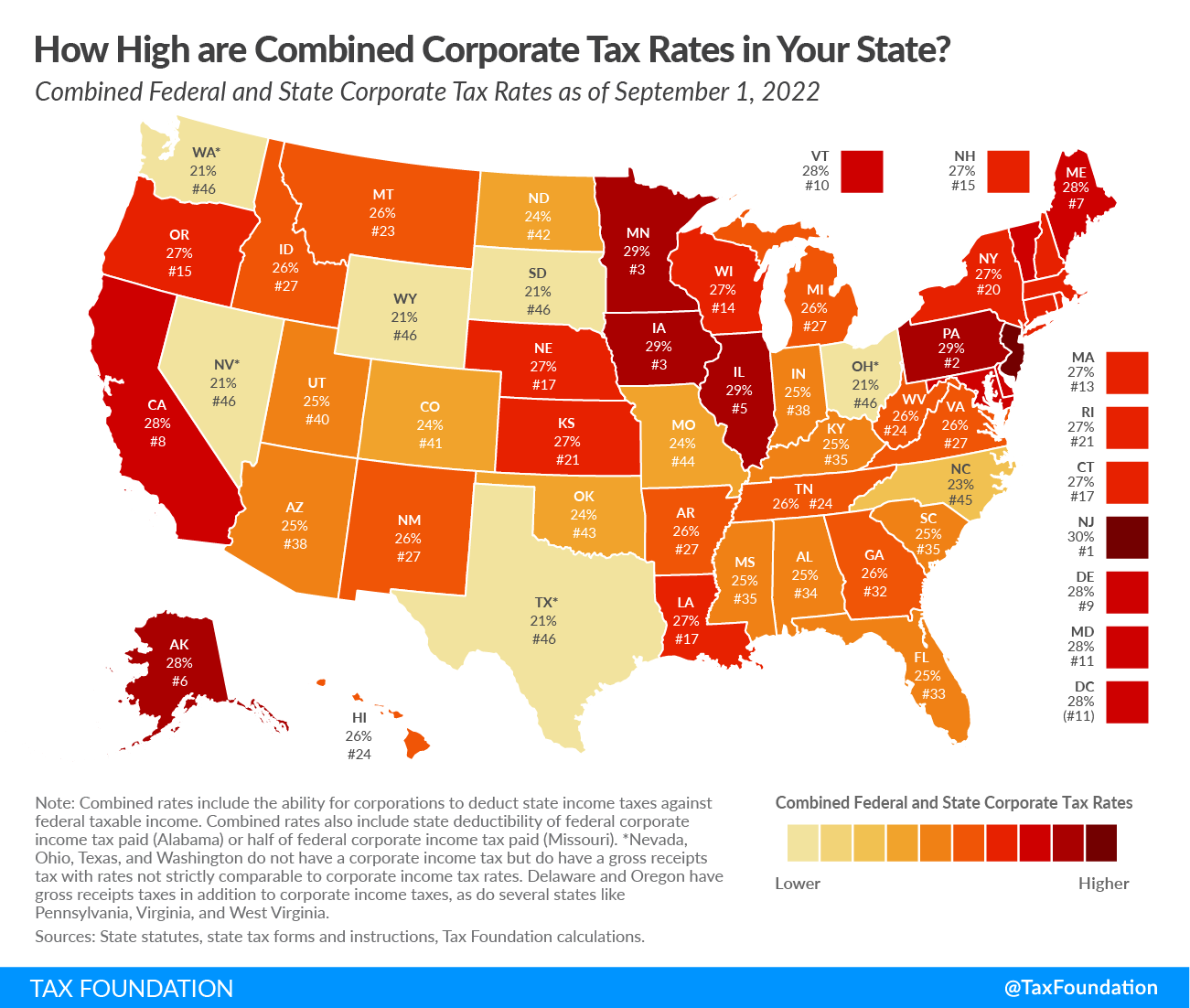

How Illinois' income tax stacks up nationally for earners making $100K - Center for Illinois Politics

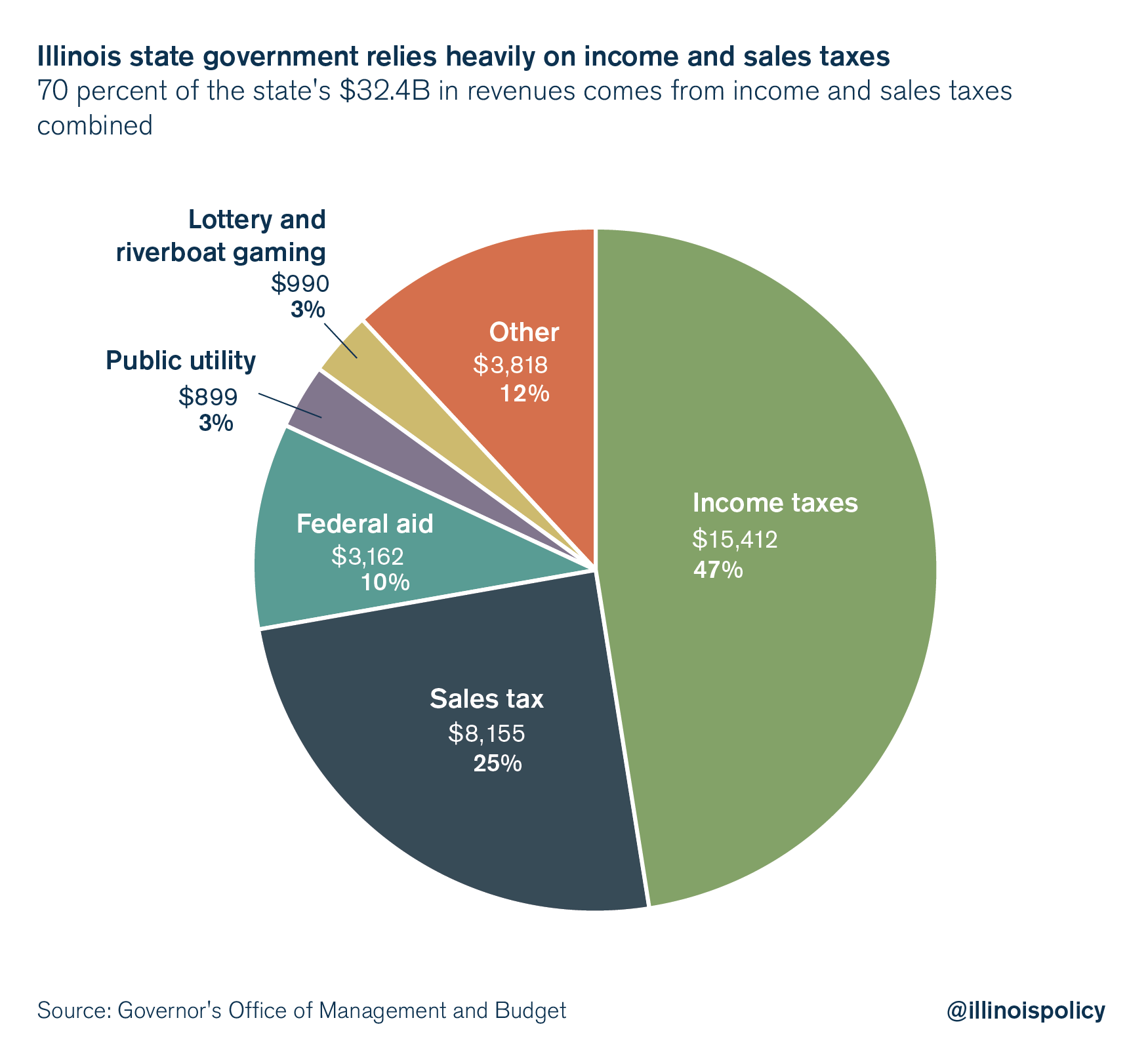

Gov. Pritzker should cut Illinois' state gasoline taxes. They're up over 100 percent since he took office. – Wirepoints | Wirepoints

Mega Millions on Twitter: "The taxes someone in Illinois will pay on the $1.28 Billion Mega Millions Jackpot prize General Illinois income tax of 4.95% Federal tax of 24% If winner is