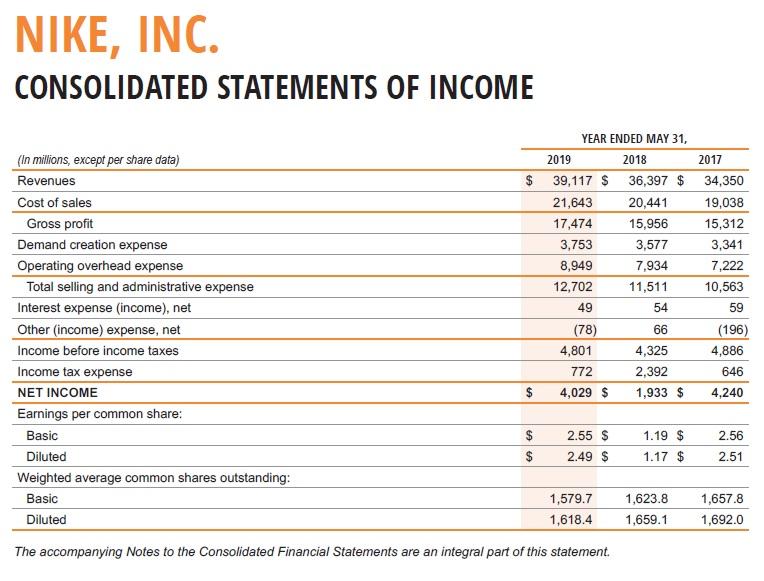

The calculation results of five main efficiency ratios of Nike Inc. in... | Download Scientific Diagram

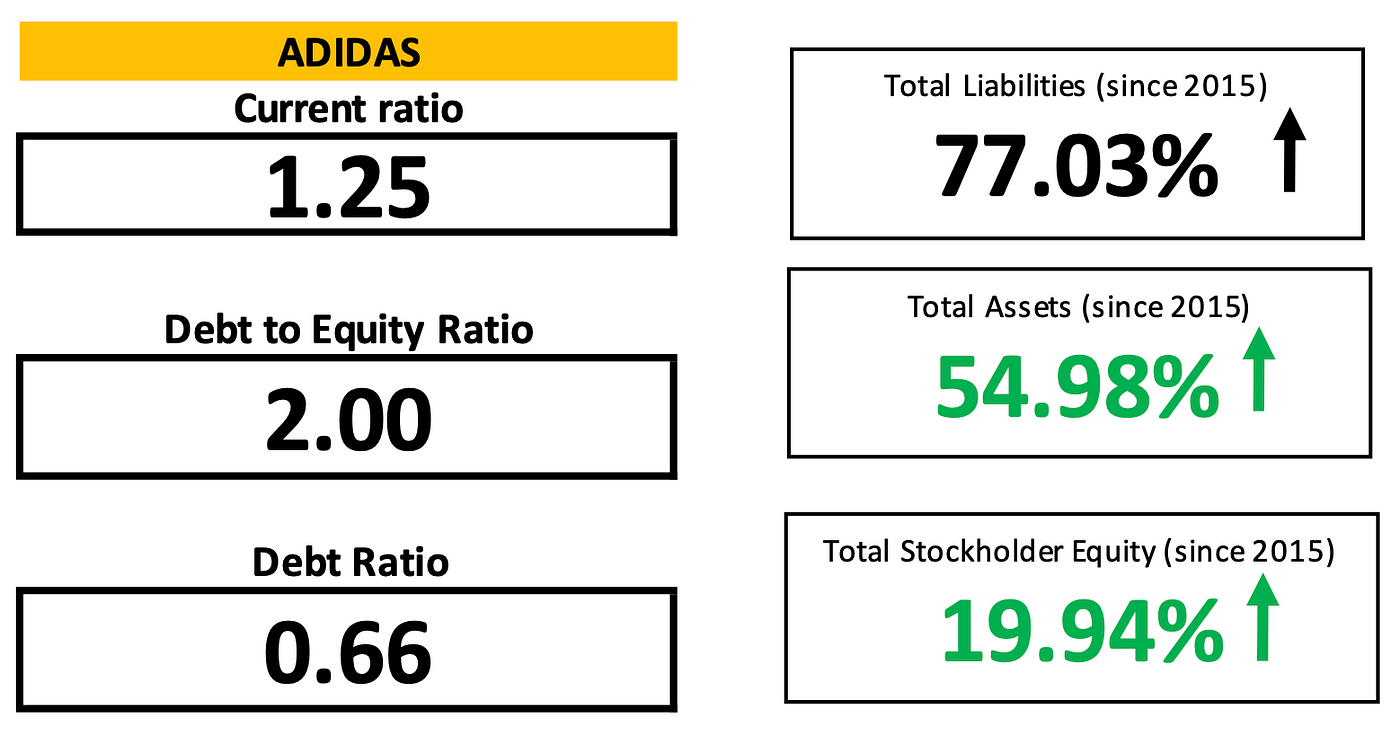

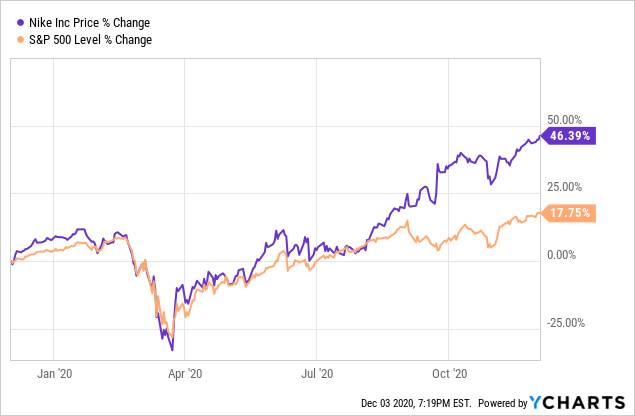

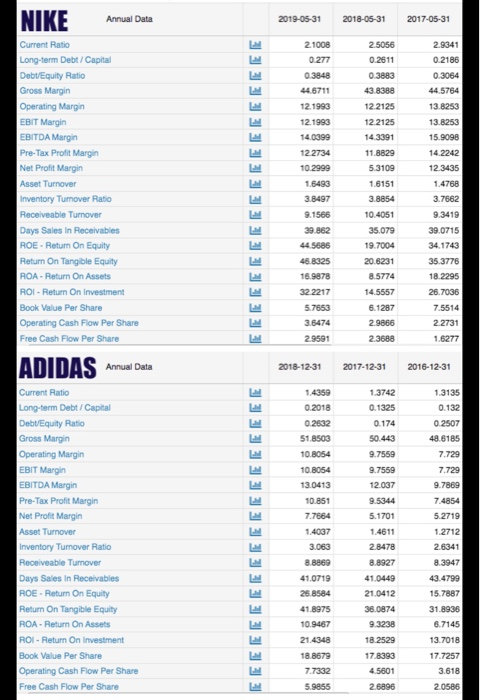

Nike vs Adidas: Where to Invest?. Nike and Adidas are both known brands… | by Kathleen Lara | Medium

The calculation results of five main efficiency ratios of Nike Inc. in... | Download Scientific Diagram

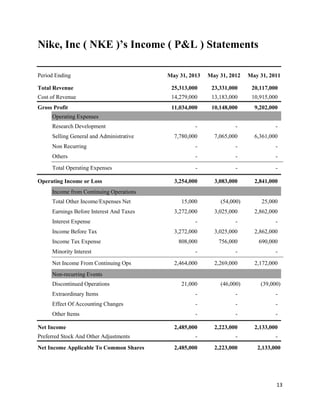

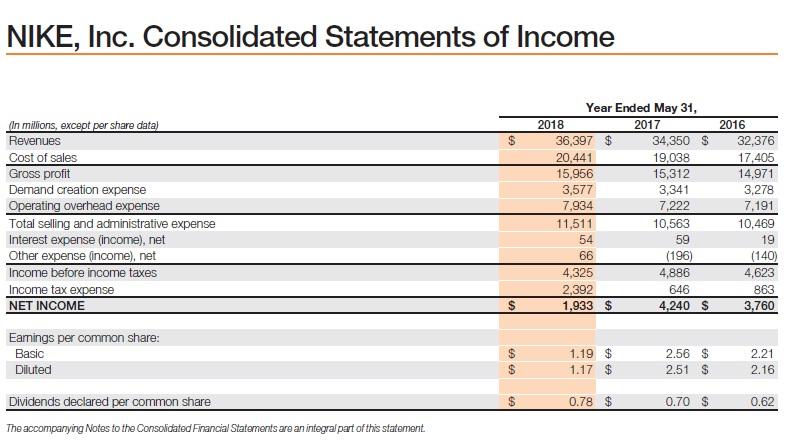

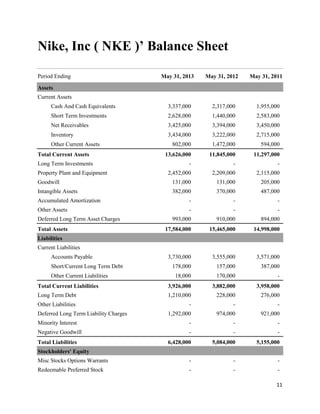

NIKE Financial Report 2020: NIKE Financial Statements and Ratios Analysis by Paul Borosky, MBA. - YouTube

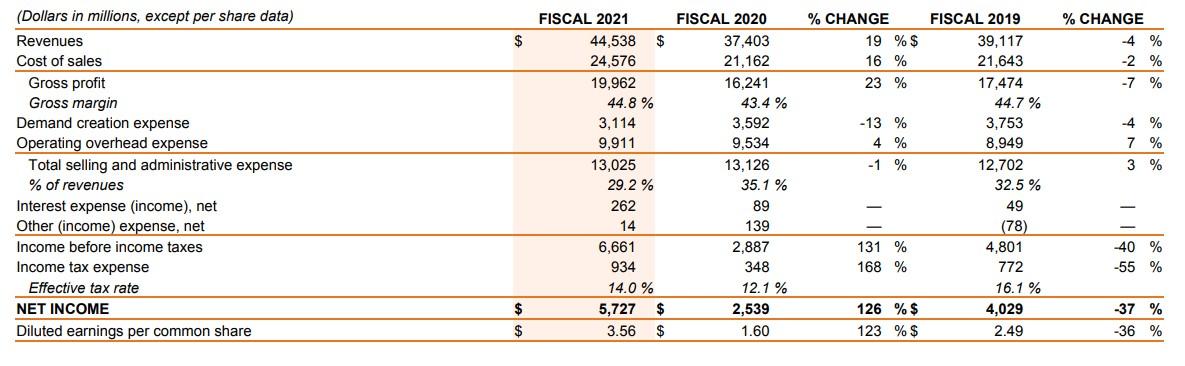

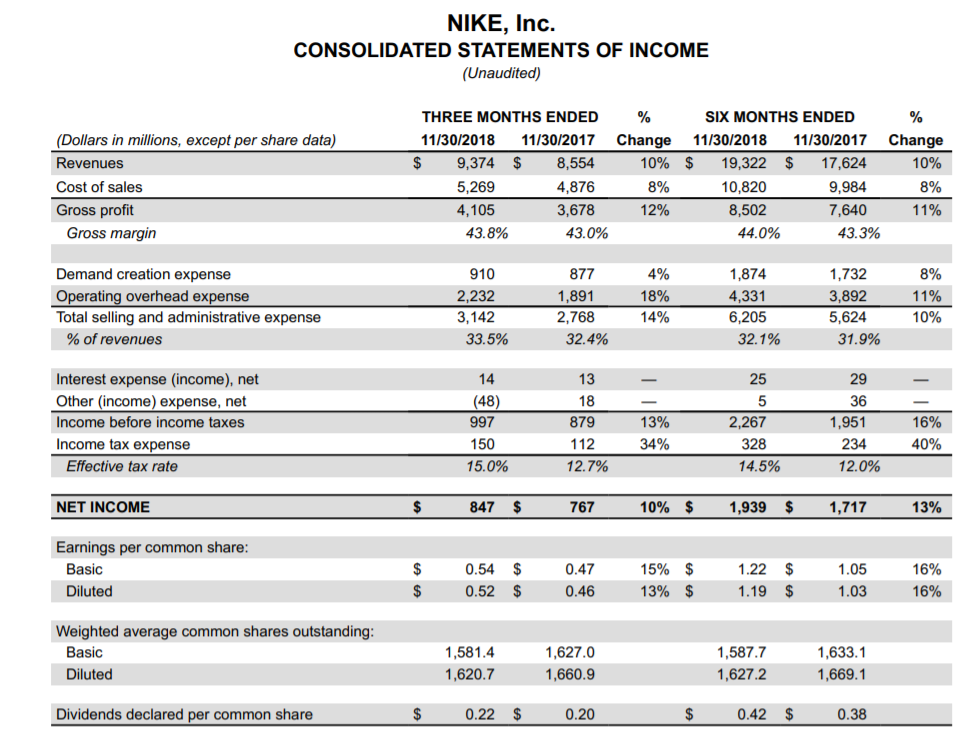

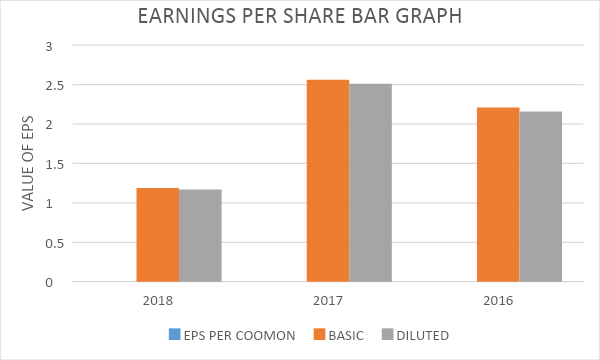

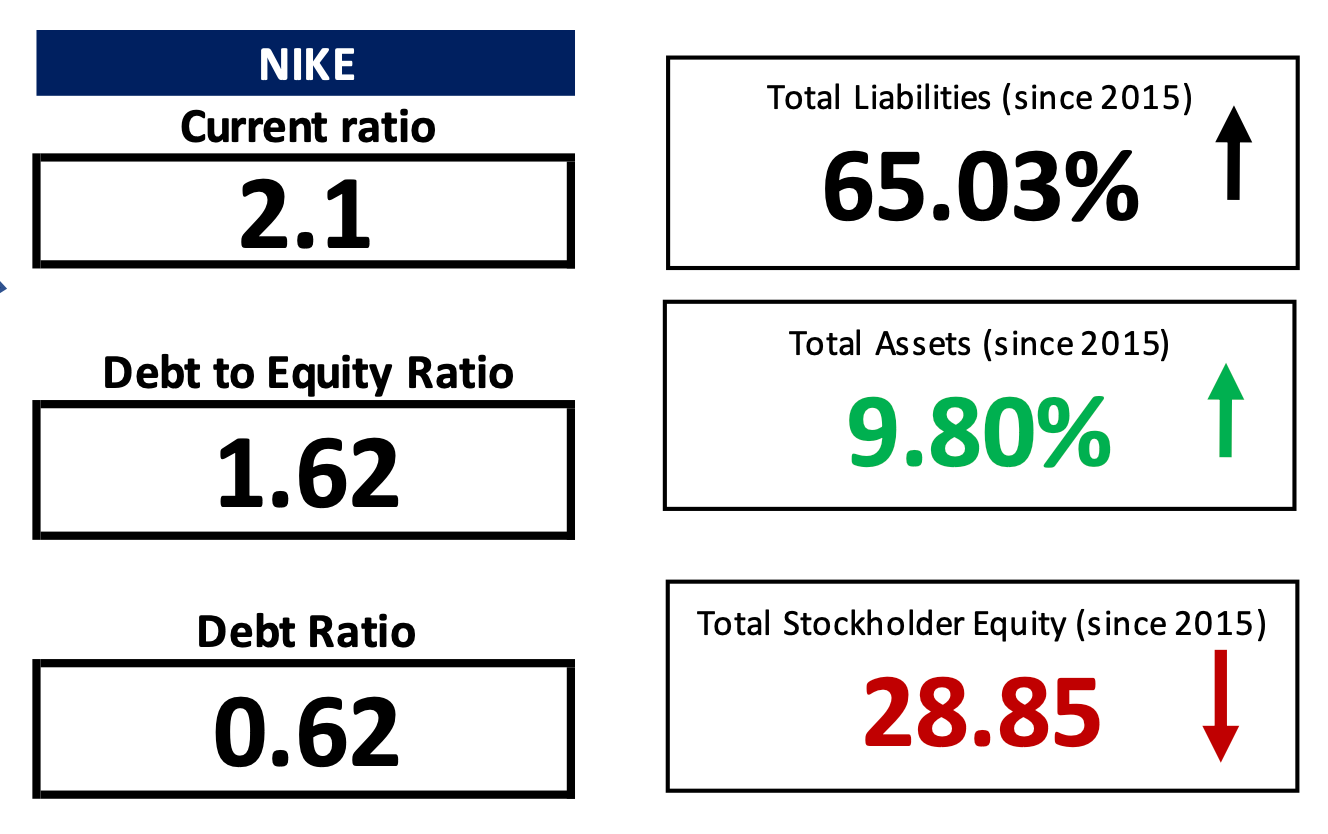

Analysis of Nike in Financial Reporting and Analysis Tutorial 25 March 2023 - Learn Analysis of Nike in Financial Reporting and Analysis Tutorial (12530) | Wisdom Jobs India

Analysis of Nike in Financial Reporting and Analysis Tutorial 25 March 2023 - Learn Analysis of Nike in Financial Reporting and Analysis Tutorial (12530) | Wisdom Jobs India