25 years of Swiss VAT: The partnership with the Principality of Liechtenstein | International Tax Review

Declaration of the Swiss acquisition VAT by non-VAT registered Swiss domiciled businesses or individuals - Tax and Legal blog

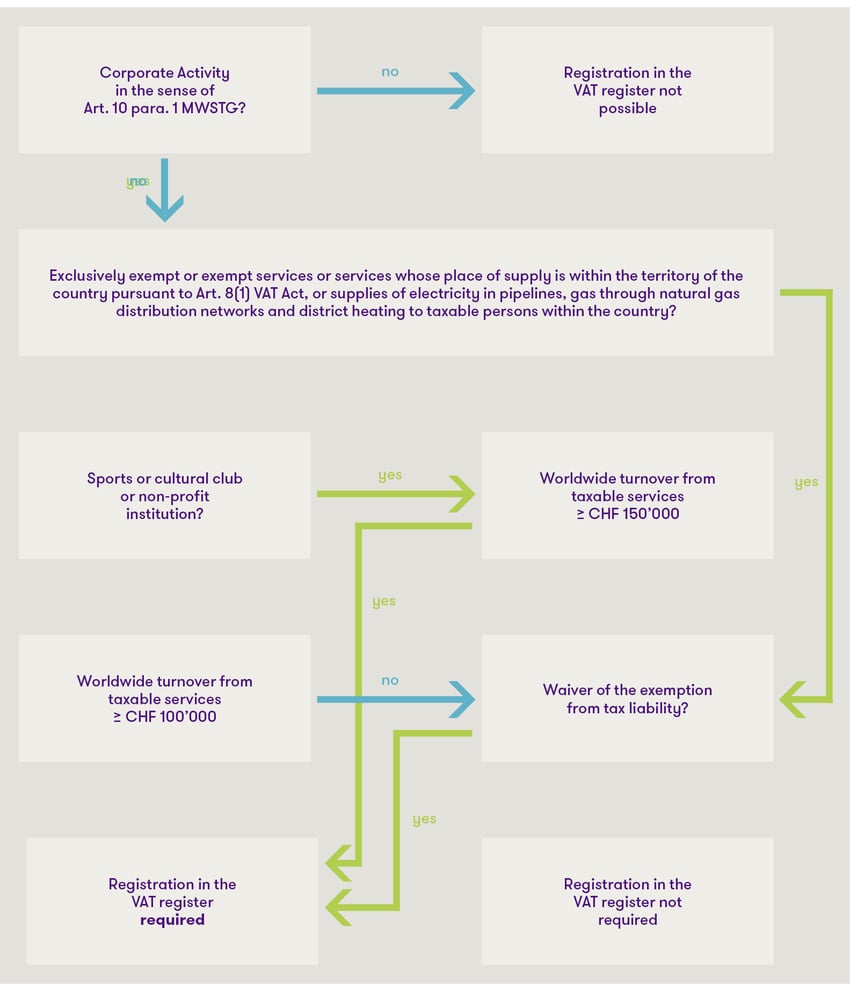

Value-added tax (VAT) in Switzerland - How does it work and when does voluntary registration make sense? | Nexova

Action required: Are you prepared for the new registration requirements under the revised Swiss VAT law? - Tax and Legal blog

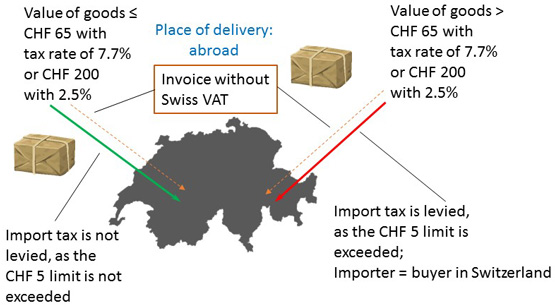

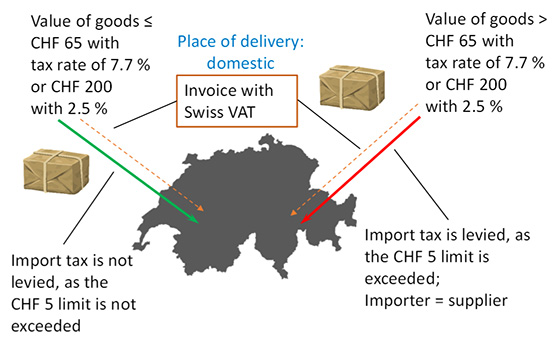

Swiss authorities level the playing field for non-resident companies selling into Switzerland – With effect from 1 January, 20