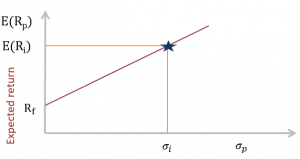

Evolution of Portfolio Theory Efficient Frontier to SML (Calculations for CFA® and FRM® Exams) - AnalystPrep

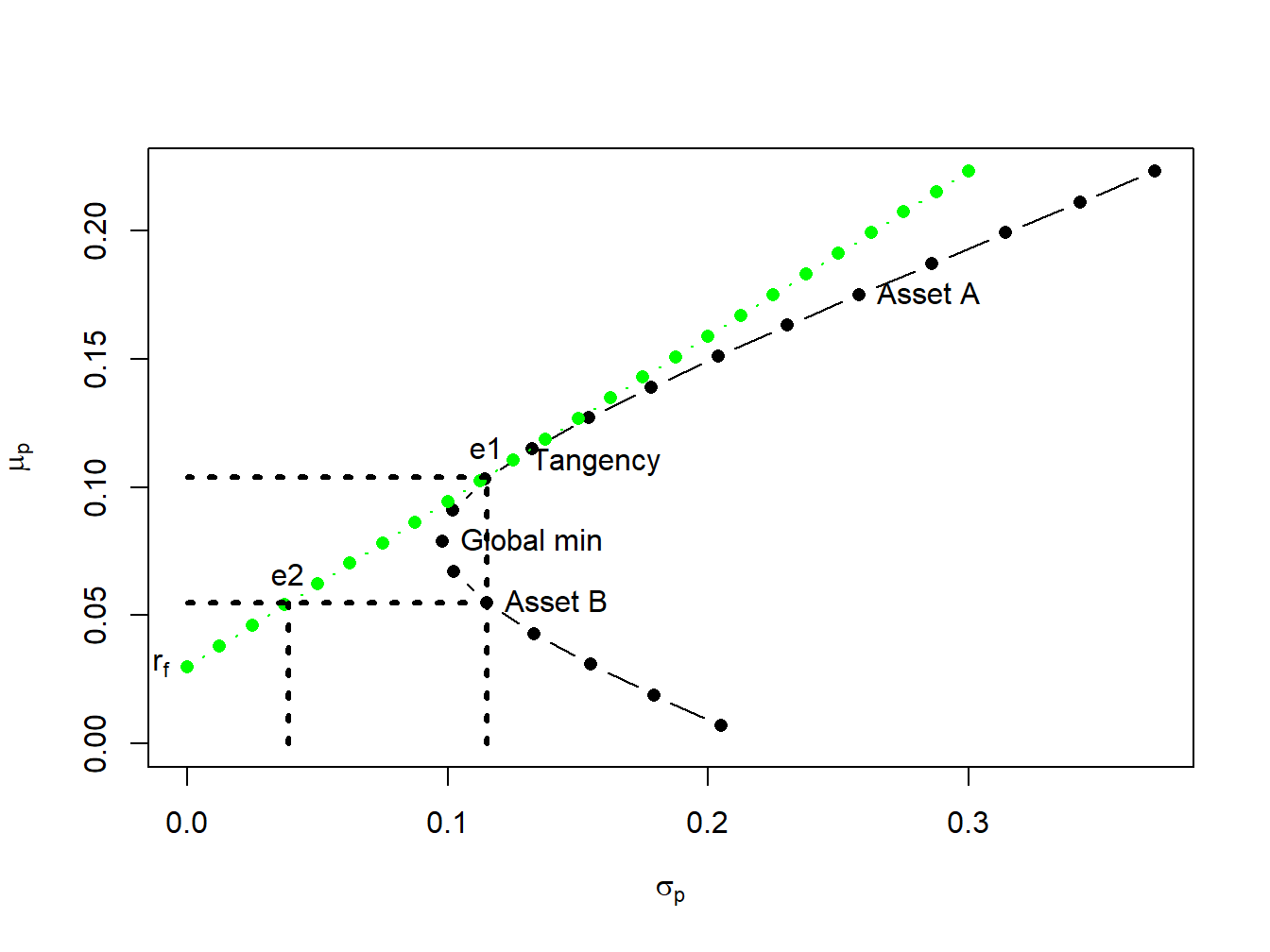

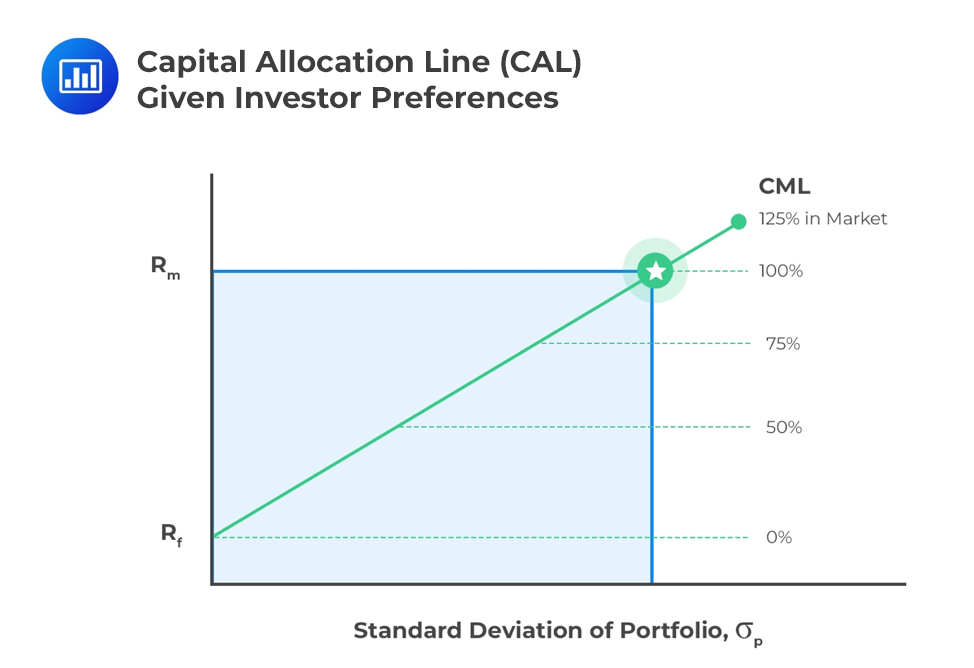

11.5 Efficient portfolios with two risky assets and a risk-free asset | Introduction to Computational Finance and Financial Econometrics with R

Financial Products and Markets Lecture 6. Model with N risky assets Assume to invest one unit of wealth in a set of N risky assets, with expected returns. - ppt download

Financial Products and Markets Lecture 6. Model with N risky assets Assume to invest one unit of wealth in a set of N risky assets, with expected returns. - ppt download

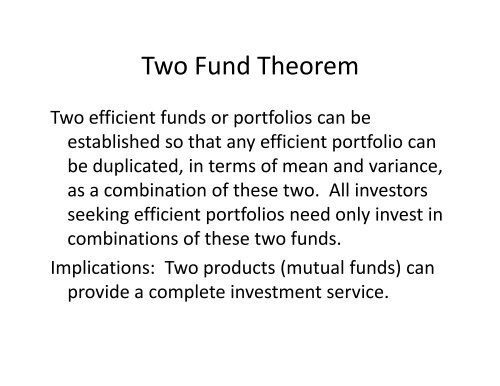

Two-Fund Separation Theorem and Applications - Module 2: Motivating, Explaining, & Implementing the Capital Asset Pricing Model (CAPM) | Coursera

![PDF] Two-Fund Separation under Model Mis-Specification | Semantic Scholar PDF] Two-Fund Separation under Model Mis-Specification | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/29799071754a463e68ed1f6452e7b2d290ed56c2/6-Figure1-1.png)

![PDF] A Note on the Two-fund Separation Theorem ∗ | Semantic Scholar PDF] A Note on the Two-fund Separation Theorem ∗ | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/e1a23c7f645bfa2242d537adc6732f30891bb740/15-Figure2-1.png)